By: Brayden Yin

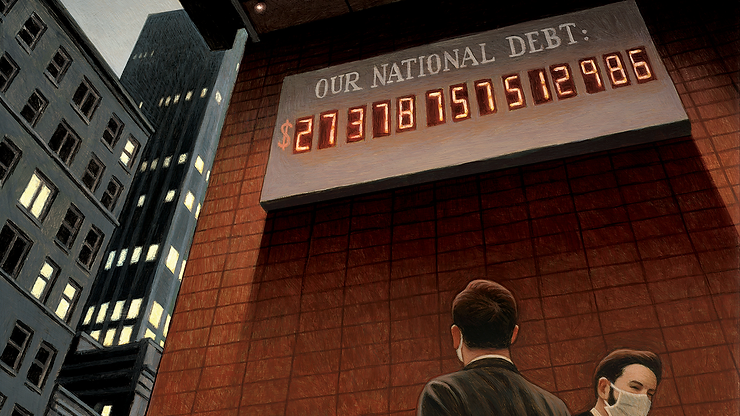

At 32 trillion dollars and still rising, the national debt is a problem for America’s financial future. Although many Americans may not at present experience the effects of our escalating debt, the dues will eventually come, bearing interest. Running massive budget deficits over time harms our economy and eventually makes us less of an international power.

According to projections by the Congressional Budget Office, or CBO, the US will have a deficit of $20.3 trillion in the next decade, between 2024 and 2033. Interest rates on loans have risen exponentially, jumping from $476 billion to $1.4 trillion. These high-interest rates force the debt higher and higher, and if left untreated, the debt will spiral out of control.

Rising interest rates force the government to spend more of their already strained budget relieving debt instead of using it to fund programs such as Medicaid and Social Security. Already this year, the US has spent more on net interest costs than Medicaid and Income Security Programs.

Rising debt also means fewer economic opportunities for citizens, as mounting inflation from paying back debts reduces government investment in businesses and slows down financial growth. It threatens programs such as Social Security, which is an essential part of American life.

With rising debt, the world will lose faith in the US dollar, a benchmark for other currencies. The national debt is a significant problem that will show its effects later, but now is the time to act to relieve the debt and create a more financially secure future.