By: Andrew Cheng

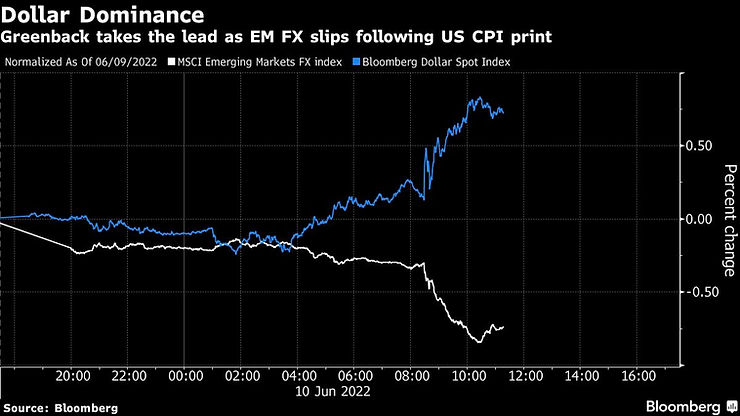

In early July 2022, the US dollar had been driven to its highest level in the decade due to the Federal Reserve’s interest rate hikes.

For the DXY index, this year, the dollar has had an outstanding result and reflects the strength of the US recovery from the pandemic. On the other hand, the dollar’s strength has caused a very different story overseas. In Europe and the United Kingdom, there is a series of currency weaknesses and the need to fight harder against inflation.

Adam Posen, president of the Peterson Institute for International Economics, said, “The dollar, euro, yen, and yuan moved in relatively small ranges for a very long time. This is the first time in decades where everybody’s down against the dollar.”

Moreover, the managing director of Bannockburn Global Forex, Marc Chandler, said, “Central banks were caught unawares by the inflation surge and are now reacting at different speeds.” He continued, “The U.S. is carrying out its most aggressive tightening since 1980, while the Europeans and the Japanese haven’t moved.” According to their description, the beneficial trend of the US dollar has caused some economic issues in other countries.

To have counter plans for those economic issues, some countries require their central banks to keep the same pace as the Federal Bank of the US. This change may help slightly but may not solve the issue entirely because there is a large gap between the US dollar and the currencies of other countries. The US dollar is the most wildly spread held currency in the world, having almost 59% of the total central bank reserves. The US dollar has been used in more than half of the world, which explains why the development of the US dollar currency will significantly impact world economies.

Source: https://drive.google.com/drive/folders/1ZsXa-Toup-UwB0p3VCH_Ju9Eebxg58zS